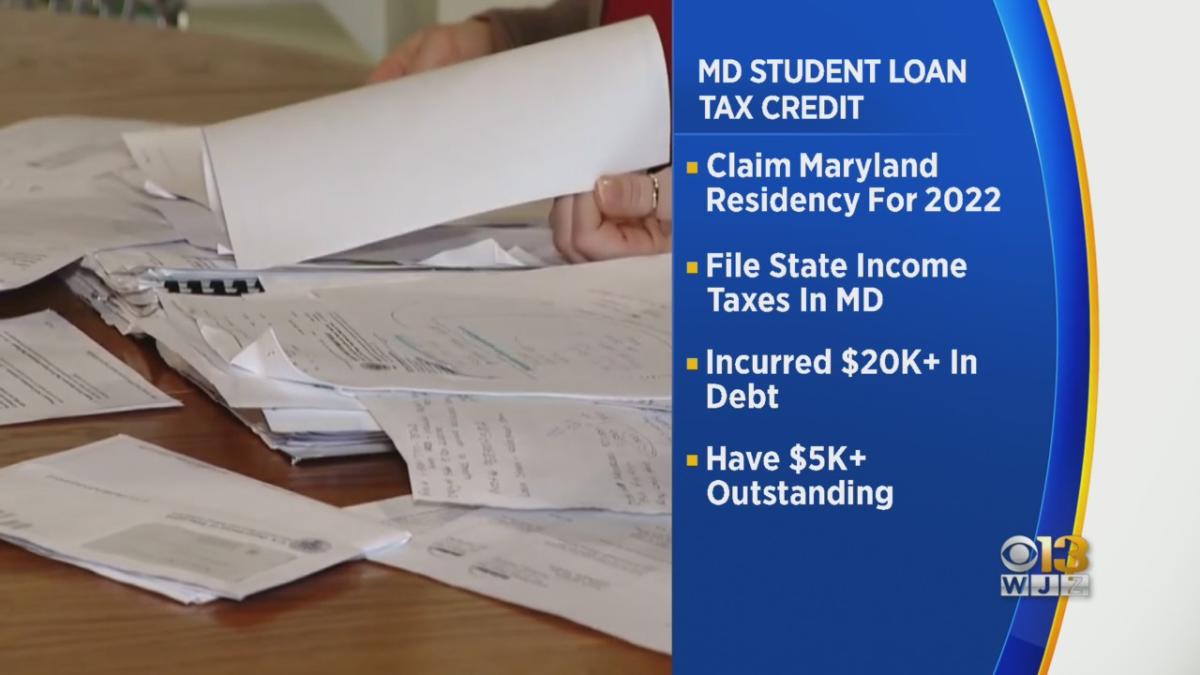

maryland student loan tax credit status

Maryland property tax rates are close to average although taxes paid can be very expensive because of the states high home values. Connecticut and Maryland are two examples.

Get information about qualified education expenses and see if a student loan tax deduction applies to you.

. The spending primarily includes 300 billion in one-time cash payments to individual people who. State and federal taxes can get tricky especially when. To use the Live Chat feature select the blue Chat with us button at the bottom.

Updated March 2 2022. Private student loans generally require a creditworthy cosigner but the cosigner does not need to be your parentsSomeone else with a good or excellent credit score can cosign the loan. Effective Tuesday May 31 2022 hours of operations for live claims agents are 800 am.

File with a tax pro At an office at home or both well do the work. The credit used to determine the Maryland estate tax cannot exceed 16 of the amount by which the decedents taxable estate exceeds the Maryland estate tax exemption amount for the year of the decedents death. The Tax Cuts and Jobs Act in 2017 overhauled the federal tax code by reforming individual and business taxes.

How high are property taxes in Maryland. Tax-free Student Loan Forgiveness. The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax.

The pandemic-era freeze on student debt payments has dramatically improved credit scores for Americans who borrowed money to pay for college the Federal Reserve Bank of New York said. A Word on Private Student Loans. Loans are offered in amounts of 250 500 750 1250 or 3500.

Government former Google CEO Eric Schmidt and leading. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawalcash back limits. This bill has the status Became Law.

It is not your tax refund. Loans are offered in amounts of 250 500 750 1250 or 3500. New Live Agent Hours.

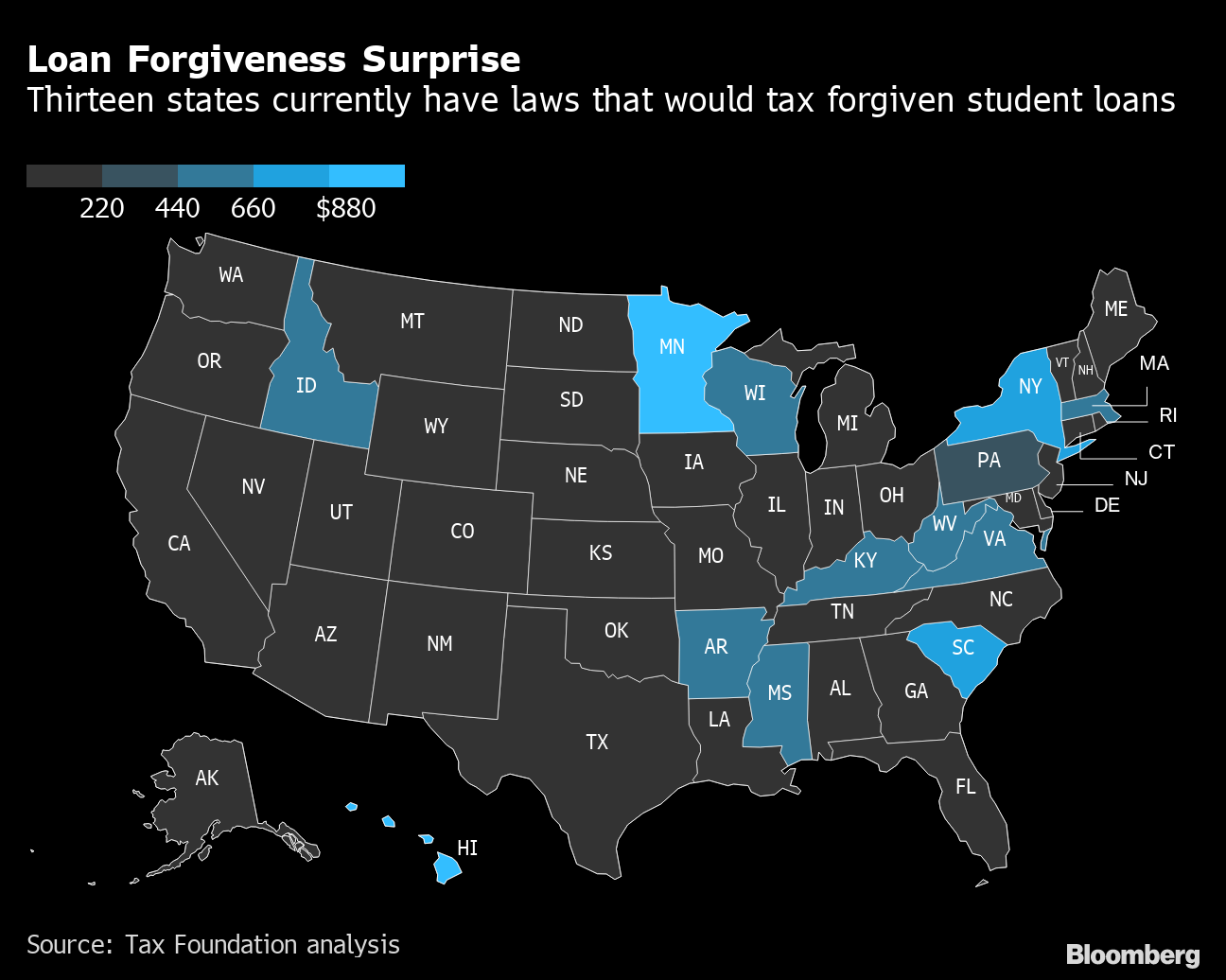

Congress also took action concerning the tax treatment of student loan debt forgiveness. The college student tax credits include the. The American Rescue Plan Act of 2021 included tax-free status for all student loan forgiveness and debt cancellation through December 31 2025.

This is an optional tax refund-related loan from MetaBank NA. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Unlike a sales tax a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases leading to tax pyramiding.

This is an optional tax refund-related loan from MetaBank NA. It is not your tax refund. To use the tool enter your SSN.

This is an optional tax refund-related loan from MetaBank NA. Loans are offered in amounts of 250 500 750 1250 or 3500. Loans are offered in amounts of 250 500 750 1250 or 3500.

Wheres My State Tax Refund Wisconsin. Your choice not to claim a deduction or credit. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

The Coronavirus Aid Relief and Economic Security Act also known as the CARES Act is a 22 trillion economic stimulus bill passed by the 116th US. Enter your SSN the tax year and the amount of your refund in order to check your status. The Housing and Civil Enforcement Section of the Civil Rights Division is responsible for the Departments enforcement of the Fair Housing Act FHA along with the Equal Credit Opportunity Act the Servicemembers Civil Relief Act SCRA the land use provisions of the Religious Land Use and Institutionalized Persons Act RLUIPA and Title II.

To check the status of your Maryland state refund online go to https. This primarily affects the forgiveness after 20 or 25 years in an income-driven repayment plan. To 400 pm Monday through FridayTo reach a live claims agent call 667-207-6520 or use the Virtual Assistants Live Chat feature during normal hours of operation.

It is not your tax refund. This link will take you to the refund status page. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

A nonprofit organization that is exempt from income tax under Section 501c3 or Section 501c19 of the Internal Revenue Code and holds a valid Maryland sales and use tax exemption certificate is still be liable for other state and. Modification of credit for prior year minimum tax liability of corporations. It is not your tax refund.

Income tax brackets for the 2021 tax year tax returns filed in 2022 are as. Wisconsins Department of Revenue has an online tool called Refund 123 that allows you to see the status of your tax refund. Breaking Local News NEXT Weather Community Journalism.

You can get a private student loan without a parent as well but theres a pretty big catch. Institutional refunds and Federal student loan flexibility. This is an optional tax refund-related loan from MetaBank NA.

This is an optional tax refund-related loan from MetaBank NA. It is not your tax refund. Student Loan Debt Relief Tax Credit.

The Maryland estate tax is based on the maximum credit for state death taxes allowable under 2011 of the Internal Revenue Code. Loans are offered in amounts. And help if you need it.

We have world-class funders that include the US. Audit. Exclusion from Federal Pell Grant duration limit.

American Opportunity Tax Credit. This is an optional tax refund-related loan from MetaBank NA. Choose the filing status you use when you file your.

Upsolve is a 501c3 nonprofit that started in 2016Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free using an online web app. The average effective property tax rate in the state is 106. Visit our Income Tax Guide for College Students and find out about student IRS forms that can be filed for free.

Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Still need help defining if your college student is tax dependent. Here are the steps for Status of Legislation.

Spun out of Harvard Law School our team includes lawyers engineers and judges. Maryland offers a tax credit of up to 1000 per year for renters age 60 and up or 100 disabled. Tax tables show the total amount of tax you owe but how does the IRS come up with the numbers in those tables.

Perhaps the most important thing to know about the progressive tax system is that all of your income may not be taxed at the same rate. It is not your tax refund. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

Tax laws in approximately 20 states would follow federal law when it comes to the tax treatment of student debt cancellation Allen said. Congress and signed into law by President Donald Trump on March 27 2020 in response to the economic fallout of the COVID disease. However many Maryland homeowners pay at least 3515 in property taxes per year as the states median home value is quite high.

Loans are offered in amounts of 250 500 750 1250 or 3500.

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

Marylanders Encouraged To Apply For Student Loan Tax Credit

Comptroller Urges Marylanders To Apply For Student Loan Debt Relief Tax Credit By Sept 15 The Southern Maryland Chronicle

Student Loans Taxes Deductions Filing Returns And Retirement White Coat Investor

30 Americans Share Their Student Loan Debts And You Can Feel How Hopeless These People Are Student Loan Debt Student Loans Student Loan Forgiveness

How To Claim Student Loan Tax Credits And Deductions Student Loan Hero

Tax Form 1098 E How To Write Off Your Student Loan Interest Student Loan Hero

Net Worth Update March 2018 Future Proof M D Net Worth Emergency Fund Worth

Learn How The Student Loan Interest Deduction Works

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Student Loan Forgiveness Means Higher Taxes In North Carolina And Possibly 4 Other States Cnet

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Home Loan Home Loans Debt Relief Programs Home Improvement Loans

Student Loan Forgiveness Is Taxed In These 13 States Bloomberg

Although There Are Lots Of Financial Reasons For Marriage Bonnie Koo Md Believes It Sometimes Makes Sen Reasons For Marriage Family Matters Unmarried Couples

Current Student Loans News For The Week Of Feb 14 2022 Bankrate