do tax assessors use zillow

Considering my assessment and zestimate were more than 100k apart I think its safe to say theyre not using it. Price history is sourced from Internet Data.

Exploit Online Data To Lower Your Property Taxes

In most cases we provide a.

. Click on your profile icon in the top right corner. Russ from Zillow here. For example a homeowner may contact Zillow to update information about their propertys features.

The 2 are very differeI was trying to analyze a property in Fort Worth TexasI looked up the taxes on Zillow as well as on the county assessor site. The 2 are very differe. That works out to a property tax rate of more than 36.

More than 20 years of deed transfers mortgages foreclosures auctions property tax delinquencies and more for both commercial and residential properties. So if say the market value of your home is 200000 and your local assessment tax rate is 80 then the taxable value of your home. Louis County MO assessors dont use Zillow.

One caution do not use Zillow to estimate the value of your home. The time that it takes to receive sale data varies widely among municipalities and largely depends on their systems to upload and share data. I found a house that is listed at 170k.

They use actual tax records for sales. The tax assessors database might have a mistake related to a propertys basic information causing the assessed value to be too. We have to file a certificate of value when a sale closes and they use actual data.

The Zestimate of value as they like to call it can be off by tens of thousands of dollars or more. More than 400 million detailed public records across 2750 US. I was trying to analyze a property in Fort Worth TexasI looked up the taxes on Zillow as well as on the county assessor site.

Zillow Has Nothing to Do With Your Tax Assessment. Zillow Has Nothing to Do With Your Tax Assessment. For example position it along the lines of per tax records or per a recent appraisal the square footage is approximately xxx.

Also dont include illegal spaces storage space or the garage in your. This is the price the government tax assessor estimates the property would sell for on the open market as of the effective date for the assessed value for the year in question. Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate.

It says the property taxes last year were 2480 on an assessed value of 68650. While Zillow has an excellent site for looking at homes many consumers are not aware that home values from Zillow are not accurate. However their accuracy varies from city to city and state to state and Redfin is more accurate in some areas.

Your property tax bill is based on the assessed value of your property any exemptions for which you qualify and a property tax rate. Youll be prompted to confirm that you want to extend your listing for 90 days. A property tax assessment.

Zillow acquires data from tax assessor and county records real estate brokerages and multiple listing services MLS. But the county rate and the town rate found elsewhere online put the property tax rate at 148 or 168. If you must market your propertys square footage include a reference for your information such as an appraisers estimation.

Feel free to contact me directly at russh at zillow dot com and well take care if this for you. Are their suppositions good and accurate. Tax assessors property values can be inaccurate though.

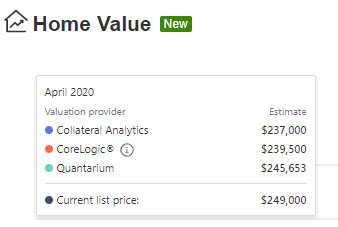

Both estimates are reasonably precise for homes currently on the market but are much less accurate for homes not currently listed for sale. Look for the More button and from the dropdown menu select Extend listing. In general we get tax data from public county recordsor third-party data providers of this data.

Look for the More button and from the dropdown menu select Extend listing. Your property tax assessment is determined on a certain date. NJ tax assessors arent dumb enough to use Zillow as a tool because Zillow is inaccurate garbage.

This flawed formula can lead to an inaccurate Zestimate of tens of thousands of dollars and in some cases hundreds of thousands. Nationally Zillow is slightly more accurate than Redfin. It also incorporates user-submitted data.

Tax assessment information is provided from public county records collected and aggregated by a third party data provider and then sent to us. Property characteristics geographic information and prior valuations for approximately 150 million parcels in. Click on Your Home from the dropdown menu.

Similarly one may ask what is a tax assessment on Zillow. Im starting to wonder if they are accurate. But you savor misleading info and flat out false info so you should be a big zesty fan.

Local governments use your tax assessment as the basis for your annual property tax bill. Similarly one may ask what is a tax assessment on Zillow. Click to see full answer.

A huge component in Zillows formula is assessed the home value or the value placed on a property for tax purposes which is usually only around 20 of the fair market value of the home. We would like to show you a description here but the site wont allow us. Bill has helped people move in and out of many Metrowest towns for the last 34 Years.

Use Bad Pricing Estimates By Zillow And Redfin To Your Advantage

Exploit Online Data To Lower Your Property Taxes

Zestimate V The Assessment Property Estimate From Zillow Com Was Not Probative Evidence Of A Home S Value According To The Indiana Board Of Tax Review Tax Hatchet

/x_reasons_zillow_estimates_are_not_as_accurate_as_you_think-5bfc3429c9e77c002631fd3e.jpg)

Zillow Estimates Not As Accurate As You Think

Are Zillow S Reported Property Taxes Accurate R Realestate

How To Use Zillow For Your Next House Hunt Home

Are Zillow Zestimates Accurate Truth On Real Estate Estimates

Are Zillow Zestimates Accurate Truth On Real Estate Estimates

Zillow S Assessor And Real Estate Database

Are Zillow S Reported Property Taxes Accurate R Realestate

Cook County Used Zillow S Zestimate Tool In Official Assessments Really Chicago Agent Magazine

How To Estimate The Size Of A Bedroom From An Online Mls Listing Like Zillow Etc Without Visiting The House Quora

Exploit Online Data To Lower Your Property Taxes

Zestimate V The Assessment Property Estimate From Zillow Com Was Not Probative Evidence Of A Home S Value According To The Indiana Board Of Tax Review Tax Hatchet

Are Zillow Zestimates Accurate Homes And Land In Sunny Sequim Washington

Using Zillow To Efficiently Value A Client S Residence